Streamline Your WBSO Administration Very easily with Traqqie

Streamline Your WBSO Administration Very easily with Traqqie

Blog Article

Introduction:

Navigating with the intricacies of WBSO (Moist Bevordering Speur- en Ontwikkelingswerk) administration is often a daunting undertaking for many companies. From accurately documenting R&D activities to complying with stringent reporting prerequisites, running WBSO can consume valuable time and means. Having said that, with the appropriate resources and methods in place, enterprises can streamline their WBSO administration procedures, saving time and guaranteeing compliance. Enter Traqqie – your ultimate associate in simplifying WBSO administration.

What's WBSO and Why is Right Administration Crucial?

WBSO can be a tax incentive supplied by the Dutch governing administration to motivate innovation in corporations. It provides a reduction in wage tax or national insurance policies contributions for qualified R&D tasks. Even so, accessing these Positive aspects involves meticulous administration and adherence to precise tips set by the Dutch tax authorities. Failure to keep up appropriate WBSO administration can lead to skipped incentives, monetary penalties, or even audits.

The Troubles of WBSO Administration:

Documentation Load: Corporations ought to maintain specific documents of their R&D functions, which includes project descriptions, hours worked, and technological enhancements.

Compliance Complexity: Navigating the intricate guidelines and rules of WBSO is usually overpowering, especially for organizations with constrained abilities in tax matters.

Threat of Problems: Manual info entry and calculation raise the threat of errors, bringing about opportunity compliance challenges and economical setbacks.

Time-Consuming Processes: Conventional ways of WBSO administration entail substantial effort and time, diverting sources from Main enterprise actions.

How Traqqie Simplifies WBSO Administration:

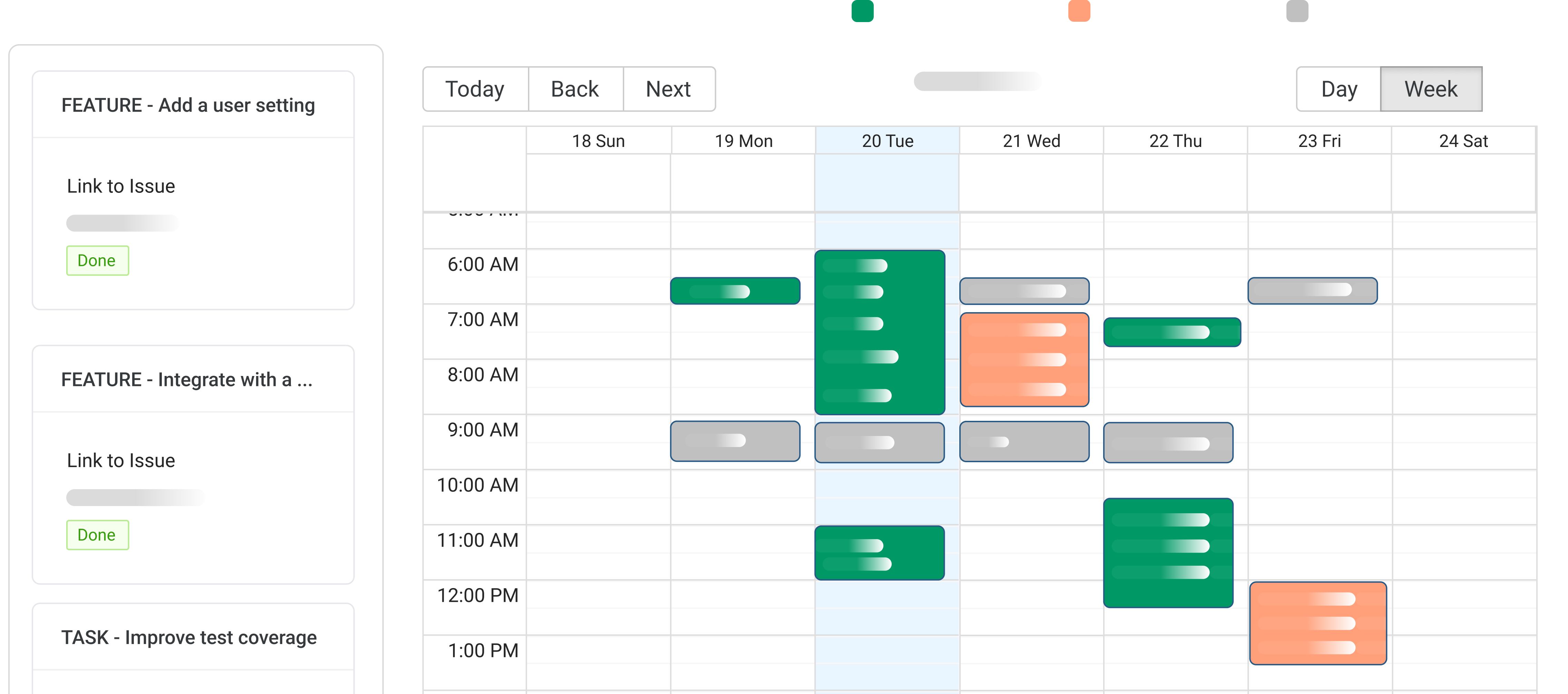

Automated Documentation: Traqqie automates the documentation procedure by capturing wbso administration true-time data on R&D functions, removing the necessity for guide record-trying to keep.

Comprehensive Compliance: With Traqqie, firms can be certain compliance with WBSO laws by way of crafted-in checks and validations, decreasing the risk of mistakes and penalties.

Productive Reporting: Make correct WBSO studies easily with Traqqie's intuitive reporting resources, saving time and resources.

Streamlined Workflow: Traqqie streamlines the entire WBSO administration workflow, from venture registration to submission, creating the procedure seamless and inconvenience-absolutely free.

Benefits of Using Traqqie for WBSO Administration:

Time Savings: By automating repetitive jobs and simplifying procedures, Traqqie will help organizations save important time which might be reinvested into innovation and advancement.

Increased Accuracy: Lower the risk of problems and ensure correct WBSO statements with Traqqie's Highly developed validation mechanisms.

Price Efficiency: Lessen administrative prices associated with WBSO administration and improve the return on your own R&D investments.

Relief: With Traqqie managing your WBSO administration, you may have satisfaction realizing that the compliance obligations are being fulfilled successfully.

Conclusion:

Effective WBSO administration is important for companies looking to leverage tax incentives to fuel their innovation attempts. With Traqqie, enterprises can simplify WBSO administration, streamline procedures, and make certain compliance easily. Say goodbye into the complexities of WBSO administration and hi there to a more effective and powerful technique for running your R&D incentives with Traqqie.